estate tax law proposals 2021

In 2022 the federal estate tax exemption is 1206 million. That is only four years away and Congress could still.

Estate Tax Law Changes What To Do Now

The current rate is an estate.

. The Biden campaign is proposing to reduce the estate tax exemption to 3500000 per person 7000000 per married couple. The Biden Administration has proposed significant changes to the income tax system. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The proposed impact will effectively increase estate and gift tax liability significantly. The federal gift estate and generation-skipping transfer GST tax exemptions that is the amount an individual can transfer free of any of these taxes are 117 million per person for 2021.

Current Law in 2021. The proposal in Congress would cut the federal exemption in half. Under current law the exemption is 750000 in fair market value for farmland but the exemption also is indexed for inflation which bumps the current exemption up closer to 119 million.

Increasing Tax Rates for Trusts and Estates. All items would be effective after December 31 2021. Increase the corporate income tax rate from 21 to 28.

Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. Starting January 1 2026 the exemption will return to 549 million adjusted for inflation.

If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. Reduction in Federal Estate and Gift Tax Exemption Amounts. If Grandma does no gifting in 2021 and dies in 2022 or thereafter when the.

Ad From Fisher Investments 40 years managing money and helping thousands of families. The Sanders bill would affect multigenerational planning with trusts as well. This year has brought many proposals to Congress that would dramatically change the tax implications for many farm businesses.

However the revised proposals have eliminated this early sunset so if enacted the higher exemption would remain available through. The proposed bill would increase the top marginal income tax rate to 396 for estates and. None of the items included in this proposal would be retroactive to earlier in 2021.

2021 Federal Estate and Transfer Tax Law Proposals. Wells Fargo Advisors Can Help You withEstate Planning. The Biden administration proposals must first be approved by Congress.

The September proposal accelerated this sunset to the end of 2021 so the base exemption available to taxable gifts and estates would be 5 million 62 million adjusted for inflation beginning January 1 2022. A reduction in the annual gift tax exemption from 15000 per person per donee to an annual per donor maximum of 20000 per year. Ad With Access To Our Free Estate Planning Checklist You Can Start Developing A Plan Today.

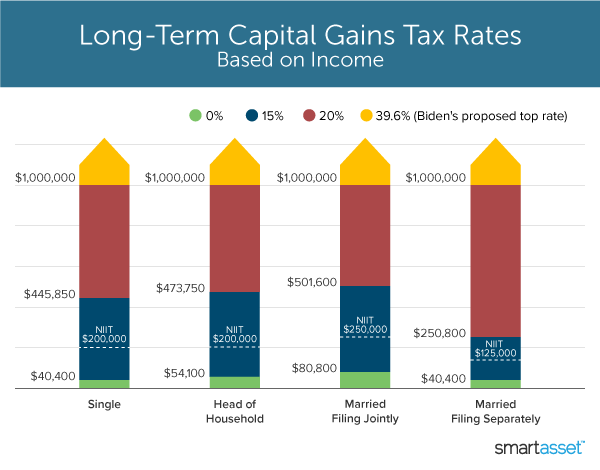

For the last 20 years the battle over estate taxes has centered around the elimination of the estate tax and the accompanying step up in basis and the amount of the. The top income tax rate of 37 and the top tax rate of 20 on investment income was not raised except for those subject to the surtaxes. The current estate gift and generation-skipping transfer GST tax exemption is 117 million per person with a top tax rate of 40 which is set to sunset at the end of 2025 to pre-2018 levels to approximately 6 million 56 million adjusted for inflation.

If passed both the federal and New York estate tax exemptions for 2022 would be about 6 million. An annual exclusion of 15000 per doneeper year is. Thus for the vast majority of Americans there is no concern.

If a decedent dies in 2026 with an estate of 11700000 the exemption amount would. Tax rates for C corporations were not raised. This means that an individual can pass up to 1206 million without paying a federal estate tax Virginia and North Carolina have both essentially eliminated their estate tax.

It includes federal estate tax rate increases to 45 for estates over 35 million with further. Under the current tax law the higher estate and gift tax exemption will Sunset on December 31 2025. Impose a minimum 15 corporate income tax on the book earnings of large corporations.

Fortunately the proposed law does not increase the estate tax rate the way that the Bernie Sanders bill would have. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Under current law the existing 10 million exemption would revert back to the 5 million exemption.

The current US117 million exemption from the generation-skipping transfer tax on gifts or bequests to. As Congress is now considering these tax law change proposals the following is a summary of some of the most important. The current 2021 gift and estate tax exemption is 117 million for each US.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Proposed effective date is retroactive to January 2021. Download Our Free Guides Today.

Payment of the capital gains tax would secure the step up in basis at death. By utilizing your exclusion now if the Administrations proposals become new law the reduction in the exclusion to 35 million could result in over 3 million. Note the tension in current year planning if this proposal is adopted.

As of January 1 2021 an individual may give up to 11700000 during life or at death without incurring any federal gift or estate tax. With inflation this may land somewhere around 6 million.

Summary Of Fy 2022 Tax Proposals By The Biden Administration

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

The New Death Tax In The Biden Tax Proposal Major Tax Change

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

What S In Biden S Capital Gains Tax Plan Smartasset

How The Tcja Tax Law Affects Your Personal Finances

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

It May Be Time To Start Worrying About The Estate Tax The New York Times

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Proposed Federal Tax Law Changes Affecting Estate Planning Davis Wright Tremaine

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Biden Greenbook Estate Tax Proposals Should You Care

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Summary Of Proposed 2021 Federal Tax Law Changes Burr Forman Jdsupra

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

It May Be Time To Start Worrying About The Estate Tax The New York Times

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation